Bizarre

FT "Risers" are now measured in Companies that he recorded the smallest loss

FTSE 100 - Risers - Mid-day

Bunzl (BNZL) 1,492.50p -0.63%

Sainsbury (J) (SBRY) 204.00p -0.83%

United Utilities Group (UU.) 881.80p -0.88%

Reckitt Benckiser Group (RB.) 5,900.00p -1.17%

Tesco (TSCO) 230.80p -1.45%

National Grid (NG.) 927.50p -1.51%

Polymetal International (POLY) 1,285.00p -1.57%

Morrison (Wm) Supermarkets (MRW) 176.55p -1.67%

Aveva Group (AVV) 3,502.00p -2.07%

Severn Trent (SVT) 2,213.00p -2.12%

The very short summary is "very bad".

If you are interested in more detail: https://en.wikipedia.org/wiki/Lost_Decade_(Japan)

In the spirit of this topic. What is the best asset class in a period of deflation?

When the Japanese were facing it after the 1989 housing crash, they had short term rates of 6% or thereabout, so they had ample of space to cut. The cuts to almost-zero (I believe the rate was no lower than 0.5 or 0.25% by 1995) still took them quite long. I suppose with everything we know about the Japanese scenario, a central bank would act much fast nowadays - however with the constraint that rates have been hovering around zero for the last ten years already. The mechanism of negative rates is not optimal, as people have the alternative of taking the cash out and storing it in their safe, so there is a natural bottom where measures stop being efficient. Uncharted territory, most of it.

Red wine.

In the 1980’s the Japanese seemed to be taking over he world financially. Then it all seemed to implode. When I started Financial Services in 1993 they used to talk about how it peaked in 1989 and how it was the place to invest as it was a great buying opportunity. It was well under half it’s peak if I recall correctly. Stayed that way for a couple of decades. Frightening thing was so many people had Japanese Funds in their pensions as ‘that’s the place to invest’.

I remember around 12 years ago going to a Fund Manager meeting and it was all focused on the BRIC economies and Japan. All the top well known managers in one room. Most interesting meeting I ever attended (the stats on China were staggering and quite frightening). The Japan fund manager said something on the lines of ‘I’ll tell you all in very basic terms the problem with Japan, no one wants to buy a telly today for £1,000 because they know next year it will be £950’. Quite simple analogy of course but very telling.

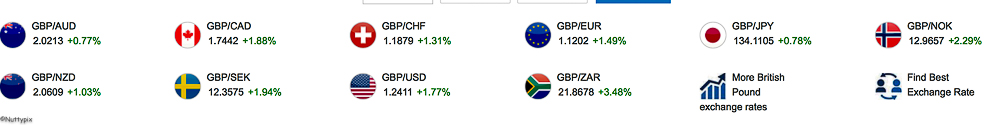

look at the £ today - must be some confidence somewhere

As you’ll know, gold has become the flavour of the month (I’ve got a bit myself truth be told) in the last 10 or 15 years. Right after Gordon decided it was better to sell a load off! Some people do use it to hedge their portfolios though, maybe 3% or 5%. Sensible to do? Who knows, especially right now.

“Gold is money, everything else is credit”; J P Morgan. He seemed to know a thing or two, right?

I see gold as a hedge against inflation and currency devaluation which considering the significant amount of money printing happening now seems likely. That said, as has been pointed out, deflation may be the issue going forward.

Diversified portfolio is the answer I guess, I’m diversifying into red wine as we speak. Cheers. 👍🏻

Somebody explain to me about this crazy buying of GBP/USD during the last three days. Wow, like there was no Sterling left tomorrow.

Someone who lies about the little things will lie about the big things too.

Perhaps because there are to many of other ugly currencies out there.

I certainly would not be looking at the Euro and Yuan at the moment. Both are built on sand. China’s debt is growing massively daily and is most exposed if there is a recession in the West. The Euro is facing an every increasing debt crisis (Italy and Spain to name a couple).

On the other hand the USD is simply to big to fail and the Swiss Franc, Yen and the GBP remain the other largest sovereign currencies.

Whoever does not know how to hit the nail on the head should be asked not to hit it at all.

Friedrich Nietzsche

It's as we discussed a few days ago Raffe. We're on the precipice of something rather ugly happening in the US (despite the incoming injection) and it seemed irrational to me to have so much faith in the dollar. Plus, we may not have a plan for paying back the money we're going to need, but at least the UK has shown some semblance of financial leadership. Just look at the EU, standard defer till later strategy. Really Raffe, the UK isn't THAT bad

Kinda the least ugliest sister scenario right now but could change.

Also diversifying into red wine, saludos para todos.

This is the big one. Forget 1929. expect a bit of a dead cat bounce then …....

It's reset time

maseman

Just tried to buy more gold, not happening...

My concern is that people only think about themselves and so when this is over they won't buy things like they did before. This behaviour is actually poisonous because basically if Bob doesn't buy a Tudor GMT the AD has to let Susan go who now can't buy a pair of trainers and so the Sports Shop has to let Terry go who doesn't go to the Pub who lets.......

So government needs to find more of a 'stick' approach to get people buying things. Like hefty fees on cash deposits over a certain level and negative interest rates. Because all of this needs to be paid for and we need money to move around the economy faster. If you expect people to pay you a salary or buy things from your business you need to do the fair thing and spend money elsewhere in the economy so others get this opportunity too.

Totally understand the sentiment, the juxtaposition is that if you are retired or nearing retirement and have managed your finances in a responsible way so as to be able to be self-sufficient in retirement, you shouldn't be penalised. Not un-reasonable to take an insular view and it's a parallel of the IHT argument, incentivise people to spend and you ultimately add to the social services burden in another way as greater employment is offset by an aging population with no savings to support themselves.

Desperate times call for desperate measures.

It's just a matter of time...

This notion completely ignores the possibility that people might well be happy and content without buying a lot of stuff they don't need in order to impress or 'keep up' with people they don't even really know let alone like

Credit to Tyler Durden.

Government will learn to fear the people if they take the stick approach on something so fundamental.

the past 8 weeks has been fruitful, for some...

As indicated by the greatdogwood above - do you expect the over 70's who have been careful to provide for their retirement and who have now seen their investments falls by £100k, £200k and above to subscribe to this theory; many may now see any dividend income that they counted upon reduced to £Nil - this group won't be spending anytime soon as their income has been significantly reduced.

Yes absolutely I agree here. Someone smarter than me will have an answer. I guess of course the point would be that as the economy picks up then their losses drop significantly but this is likely to be an event that takes a while (years) to.recover from and of course if they are drawing down income from a now much smaller pot this becomes a big issue.

Paradox of Thrift? We’d be better off if we were a bit more frugal and bought a lot less stuff we didn’t need, and had the nous to decide to do this for ourselves. For the government to mandate wanton spending would be very irresponsible. Appreciate your viewpoint makes sense if you don’t have any savings.

I just wonder how much of these Government "hand-outs" will be spent on the usual junk from China via Amazon and eBay - mobile phones, the Sky and Netflix subscriptions won't go as they are regarded as "necessities"

Excuse me - I suppose I'm being too harsh!!

I spent a lot of money on booze, birds and fast cars. The rest I just squandered.

another day

FTSE 100 down 2% on opening

£ down a smidgen versus US$ and Euro

and the oil price??

(ITV share price getting hammered - I bought £5k's worth on a punt at 94p two weeks ago - now 63p - I was told be my son-in-law, who works in the industry to be careful)

Last edited by BillN; 30th March 2020 at 09:30.

I started buying some FTSE 100 ETF this morning. Small 100 shares of ISF @ 530, and have put another limit buy order 100 @ 500 as and when it gets there. Aiming to slowly build up to a £5k position over the coming weeks/months.

Oil price is heading South even as I type. Next OPEC meeting is April, 6th I think. The Russians have been building a slush fund to get themselves through this even and could be in the for the long haul. It's an attack on Western, middle East and US oil suppliers.

Calling the bottom will be difficult.