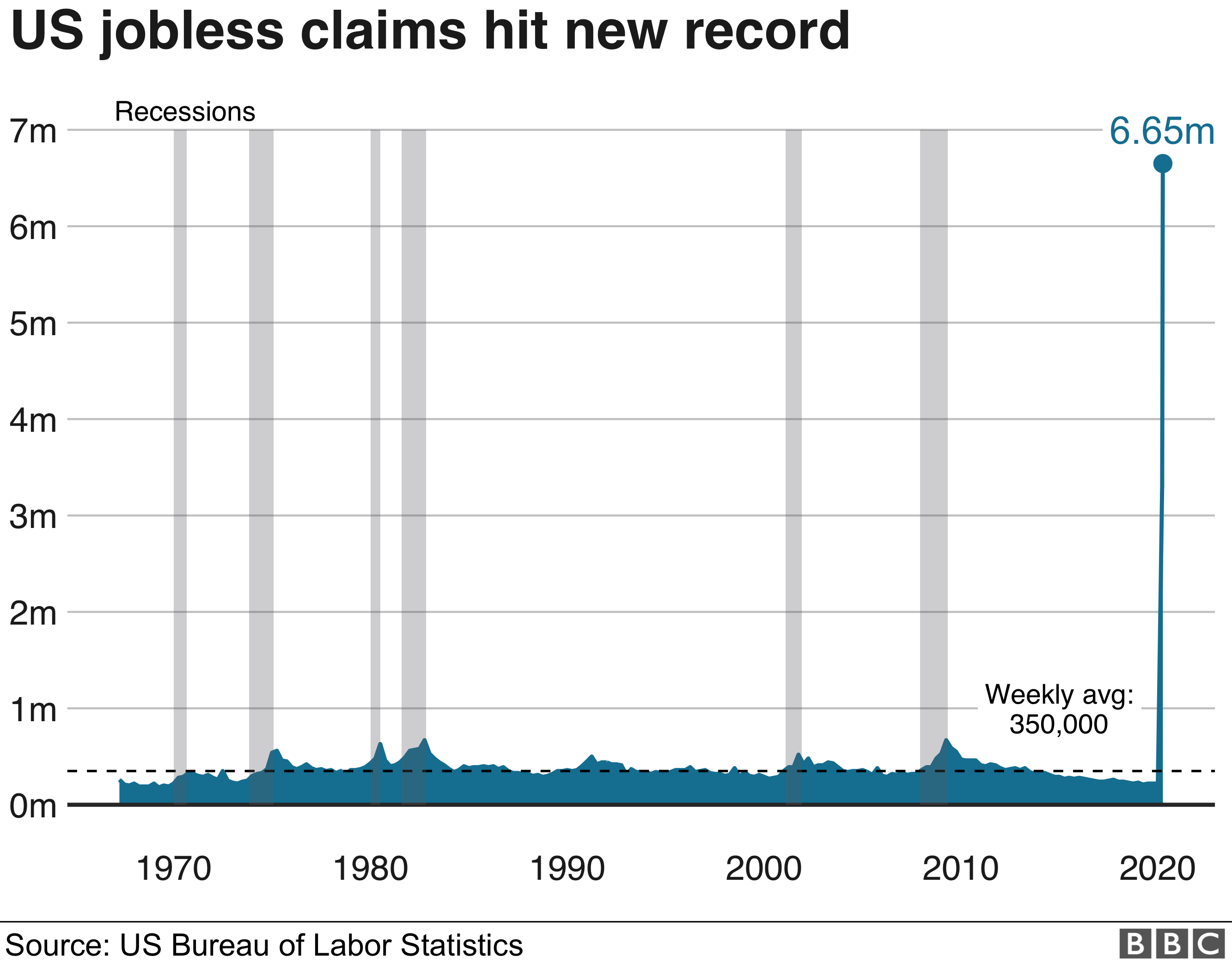

Halifax has 95,000 people ask for the 3 month payment holiday in the first week. That is an incredible amount for just one lender. Multiple that across the lenders and it’s a serious amount.

Many of those people don’t even need it (obviously many do as well), they think it’s a freebie. How do I know? We’ve had loads of calls and emails about it and a lot of people interpreted it as a free holiday.

I think historically our memories are short when we return to normal and we forget about stock market blips, house price falls and recessions. This time I’m sure it will be different. People will value things differently going forward, hopefully in a positive way.

Reply With Quote

Reply With Quote